Market development and trends

In today’s fast-moving labour market, where scarcity and agility are key factors, insights are crucial. HeadFirst Group addresses this need through Strive, the platform where thousands of assignments are posted annually and over 260,000 professionals are actively registered—ranging from independent professionals to supplier-employed professionals who submit proposals for assignments.

A representative view of the market

With approximately 20,000 assignments processed through the platform each year, Striive provides a representative sample of overall market activity. This extensive dataset yields valuable insights into key labour market trends.

From scarcity to recruitment feasibility

While discussions often focus on "scarcity", a more actionable concept is recruitment feasibility: the ease or difficulty of attracting qualified professionals. By analysing indicators such as the number of suitable candidates responding to a given assignment, the feasibility of filling a role can be assessed more accurately.

Visibility into rates and trends

Thanks to normalised and enriched data, clear insights into rate developments by field are possible. This supports detailed trend analysis

in areas such as:

-

The distribution of skills across age groups and industries

-

The evolution of skills over time

-

Sector-specific demand for skillsets—for example, differences between the energy and financial sectors

-

Rate development over time

-

The relationship between scarcity and compensation

-

Evolving hiring behaviours, including a growing preference among some clients to work exclusively with suppliers

Increasing labour market flexibility

The shift toward a more flexible labour market is increasingly evident—driven by worker preferences, demographic changes, and the growing impact of remote work.

Targeting a niche workforce

-

The core focus lies in high-end, white-collar placements, particularly within the STEM segment, with average hourly rates exceeding €90.

-

Historically, this segment has shown limited sensitivity to economic slowdowns due to its business-critical nature. Even during the COVID-19 crisis, companies in this space demonstrated resilience and continued growth.

-

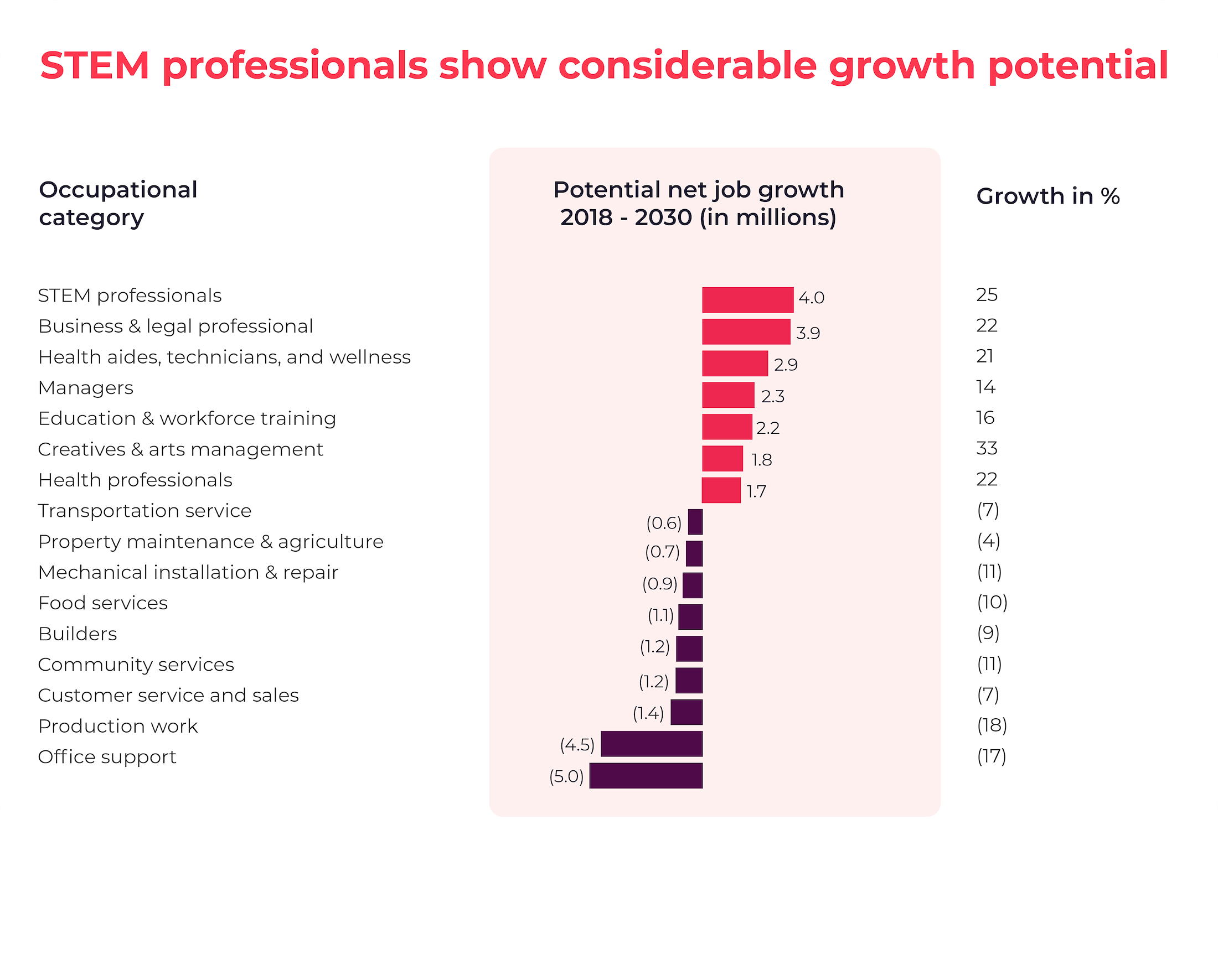

STEM professions are projected to see the largest net job growth of all occupational categories between 2018 and 2030—an estimated 4 million jobs or 25% growth.

Resilience to cyclicality

-

As a result of the rising demand for STEM professionals (especially highly skilled contingent IT workforce) in combination with the digitalisation of the economy and scarcity of IT workforce, STEM staffing businesses have shown to be resilient to cyclicality.

-

Continuous need to attract and manage high value-add personnel in a market with structural undersupply, and less risk of being affected by automation.

-

Even during COVID-19, these businesses have shown great strength despite the economic downturn and have continued to grow.

Automation & scarcity of highly skilled workers

Persistent shortages of highly skilled professionals—particularly in STEM fields—are intensified by rising automation and the use of AI. As a result, clients are increasingly seeking access to critical roles via contingent staffing or alternative solutions.

Professionalisation & digitilisation of HR

The professionalisation and digital transformation of HR and talent processes have driven sustained growth in the adoption of services such as MSP, RPO, and VMS. As the boundaries between contingent and permanent labour continue to blur, demand is growing for integrated total talent management solutions.

Increasing regulatory complexity & compliance

Labour market regulation continues to evolve to reflect changing dynamics and to reduce imbalances. Below are several key developments:

Job market legislation in the Netherlands

Legislation aimed at reforming the labour market is constantly evolving. Former Minister Van Gennip, the former Minister for Social Affairs and Employment, introduced a broad package of measures to reform the labour market. The current Minister Van Hijum has largely adopted these legislative proposals. Several legislative proposals are being considered in the House of Representatives.

Cancellation of Enforcement Moratorium as of 1 January 2025

As of 1 January 2025, the enforcement moratorium has been lifted. From this date, the Tax Authority can once again directly impose back taxes and correction obligations in case of false self-employment. Politically, it has been emphasised that this will be a "soft landing." This means that an initial company visit will take place, during which inspectors will discuss the hiring of external contractors with the organisation. No fines will be imposed in 2025, except in case of malicious intent.

Bill on Clarification of Employment Relationships and Legal Presumption (VBAR)

The draft VBAR bill aims to create a clearer distinction between employees and self-employed individuals and to combat false self-employment. However, the proposal received a critical opinion from the Council of State. As of this writing, it is still unclear whether the draft bill, in its current form, will proceed to the House of Representatives. However, there is broad support for the second part of the law, which concerns the legal presumption of employment status under a certain hourly rate. This part is likely to be introduced.

Debate on the Act on the Admission of Temporary Employment of Workers (WTTA)

The draft Act on the Admission of Temporary Employment of Workers (WTTA) was debated in the House of Representatives on Wednesday, 12 March 2025. The second part of the debate took place on Thursday, 27 March 2025. There is broad political support for introducing the admission system, although concerns have been raised regarding the feasibility and enforceability of the law. The law is adopted by the House of Representatives in 2025 and will be debated in the Senate soon.

Delay of the Basic Insurance for Self-Employed Disability Act (BAZ)

The draft Basic Insurance for Self-Employed Disability Act (BAZ) has been delayed. The mandatory disability insurance is not feasible for the Tax Authority and the Employee Insurance Agency (UWV). The opt-out provision in the proposal is politically sensitive for the ruling parties VVD and BBB. Further information on the proposal is expected in 2025.

Incorporating the EU Platform Directive in National Legislation

The EU Platform Directive was adopted in October 2024. The Netherlands has two years to implement this directive into national legislation.

HeadFirst Group remains in contact with members of parliament, policy officers, and other stakeholders to influence labour market legislation and expand our network. We continue to advocate for a flexible and dynamic labour market that allows room for self-employment. We do this by engaging in discussions, organising meetings, writing opinion articles, and publishing reports on the labour market and the self-employed population. We will also continue to present our clear vision in 2025.